texas estate tax return

Unless a taxable entity qualifies and chooses to file using the EZ computation the tax base is the taxable entitys margin and is computed in one of the following ways. But even though theres no estate tax in Texas you or a family member still might have to pay federal estate taxes.

Here S When Married Filing Separately Makes Sense Tax Experts Say

Power of Attorney Forms.

. Texas has neither an estate tax a tax paid by the estate nor an inheritance tax a tax paid by a recipient of a gift from an estate. Give it a Try. One key difference is that the executor of the estate files the estate tax return based on the total value of the decedents assets.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Total revenue minus compensation. Form 706 estate tax return In addition to regular income tax a second kind of tax can be levied against certain estates.

Affidavit of Heirship for a. This is because Texas picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return federal form 706 or 706NA. The gross estate tax is computed and credits are applied.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The due date for filing fiduciary income tax returns can be extended only if the executor clearly describes the reasons causing the delay. For 2012 the estate tax applicable exclusion amount was 512 million.

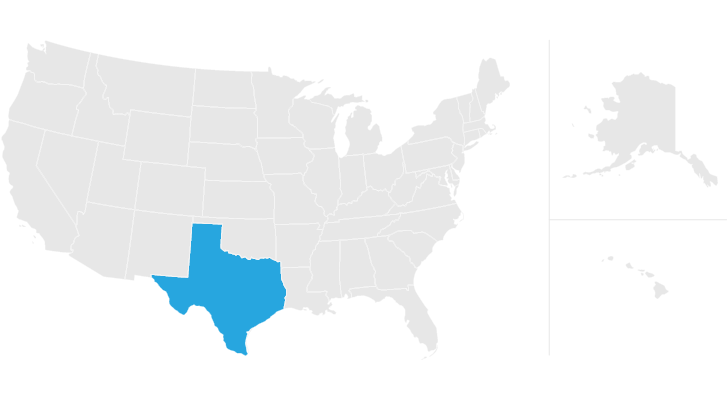

Fortunately Texas is one of the 39 states that does not have an estate tax. Income earned during the estate administration is reported on IRS Form 1041 Fiduciary Income Tax Return. There are two kinds of taxes owed by an estate.

The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. You would pay 95000 10 in inheritance taxes. Generally the estate tax return is due nine months after the date of death.

The gift tax return is due on April 15th following the year in which the gift is made. Any estate taxes are paid out of the estates funds before distribution of those assets. 50-801 Agreement for Electronic Delivery of Tax Bills PDF 50-803 2021 Texas Property Tax Code and Laws Order Form PDF 50-813 Revocation of Appointment of Agent for Property Tax Matters PDF 50-820 Notification of Eligibility or Ineligibility to be Appointed or Serve as Chief Appraiser PDF.

The executor must also file a separate Schedule K-1 Form 1041 for each beneficiary and provide a Schedule K-1 Form 1041 to each beneficiary by the time that Form 1041 is filed. This return must be filed if gross income of the estate is 600 or more. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Tobacco Cigar Cigarette and E-Cigarette Forms. Natural Gas Tax Forms. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Edit Sign and Save US Estate Tax Return Form. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Texas estate tax. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

This estate tax form files. Amounts exceeding the applicable exclusion amount are taxed at 40 up from 35 in 2012. Ad Web-based PDF Form Filler.

Contact us today at 512-505-2753 to learn more. Texas law allows the person writing a will to include a provision in the will for independent administration of the estate upon his or her death. 0 1 812 Reply.

More than 80 percent of the estates probated in Texas are independently administered. If an estate is worth over 117 million IRS Form 706 must be completed within 9 months of the death. Allow the focused estate planning attorneys at Ibekwe Law PLLC in Texas to help guide you through the Texas estate taxes and inheritance laws toward an estate plan that works for you and your loved one.

It only applies to estates that reach a certain threshold. If an estate is subject to estate tax someone will need to file Form 706 a federal estate tax return on behalf of the estate. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. His assets were held in a living trust that became an irrevocable trust upon his death. For that reason its a good idea to understand the big picture when it comes to estate taxes.

The language for this provision is. Estate tax also called the death tax applies to estates worth 1158 million or more. Texas Estate Tax.

You are required to file a state business income tax return in. Underage Smoking Regulatory Forms. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041.

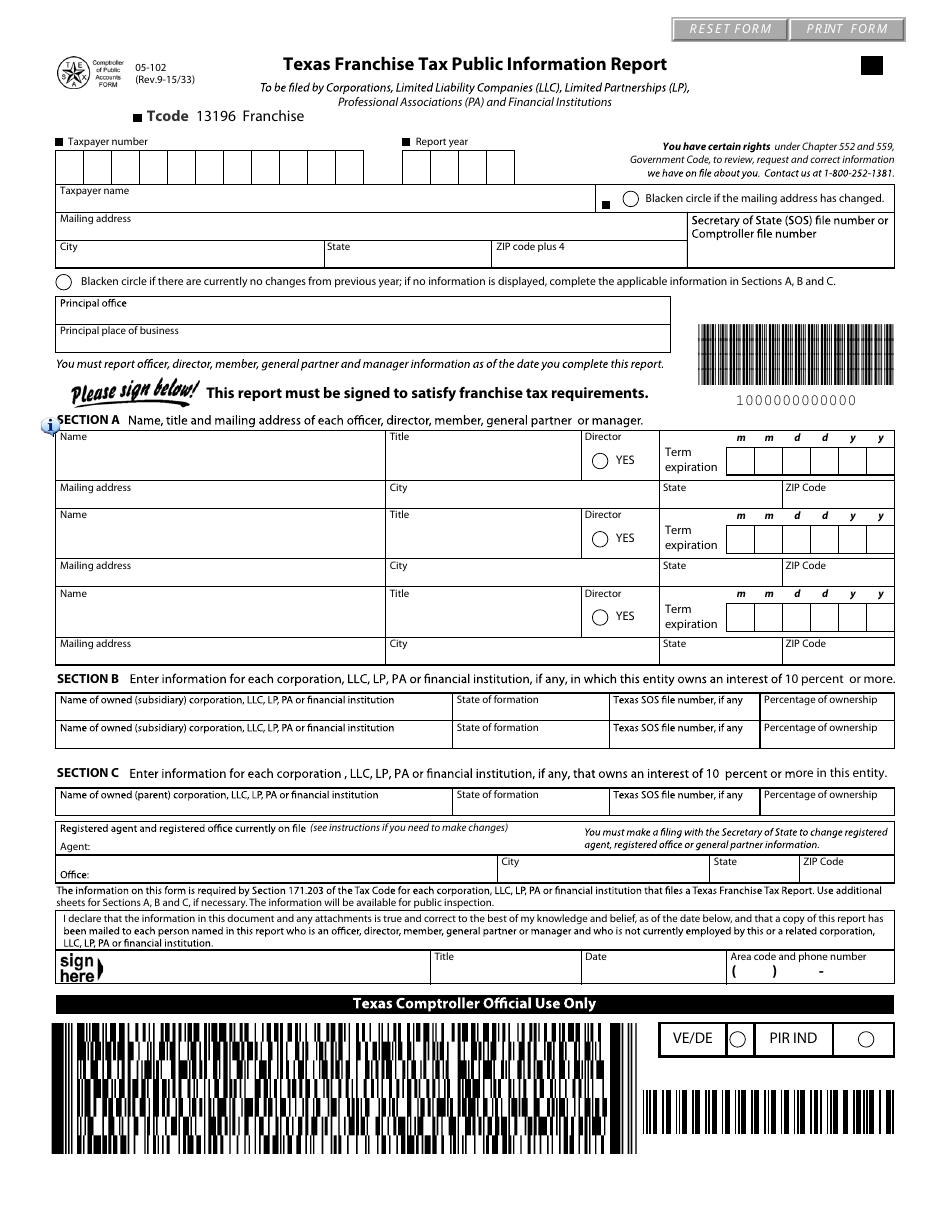

Affidavit of Heirship. How do I file Texas taxes for an estate The reference is probably to the Texas Franchise Tax but you do not have to file for an estate. Sexually Oriented Business Fee Forms.

One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. TurboTax has no info on your website.

There are two kinds of taxes owed by an estate. Thatll make many native Texans breathe a sigh of relief. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005.

It is one of 38 states with no estate tax. This page contains basic information to help you. Completing Form 706.

On Any Device OS. The 1041 federal return was for the estate of my father who died in the middle of 2018. Based on Texas law if an estates value estate exceeds 114 million you need to submit an estate tax return before you can finalize the estate.

Franchise tax is based on a taxable entitys margin. Total revenue times 70 percent. Total revenue minus cost of goods sold COGS.

The state business return is not available in TurboTax. Texass estate tax system is commonly referred to as a pick up tax. But it TurboTax says I have to file a state business income tax return in Texas.

Texas also doesnt have a state-wide estate tax. What Is the Estate Tax. 1 Best answer Accepted Solutions.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Mixed Beverage Tax Forms. The Estate Tax is a tax on your right to transfer property at your death.

This is NOT a fill-in-the-blank form. For 2020 the estate tax applicable exclusion amount was inflation adjusted to 1158 million. Near the end of the interview procedure TurboTax stated.

If you need longer you can request an extension of up to 6 months to complete it. Texas does not levy an estate tax. Affidavit of Heirship PDF Provided by the Texas Comptroller.

Estate income tax returns Form 1041 are very similar to individual income tax returns but permissible deductions may differ. This is because the amount is taxed on the individuals final tax return. Register and Subscribe Now to Work on TX 01-114 More Fillable Forms.

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Form 05 102 Download Fillable Pdf Or Fill Online Texas Franchise Tax Public Information Report Texas Templateroller

What Is The Probate Process In Texas A Step By Step Guide

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Texas Estate Tax Everything You Need To Know Smartasset

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Federal Income Tax

Do I Have To Pay Taxes When I Inherit Money

Irs Announces Higher Estate And Gift Tax Limits For 2020

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Texas Estate Tax Everything You Need To Know Smartasset

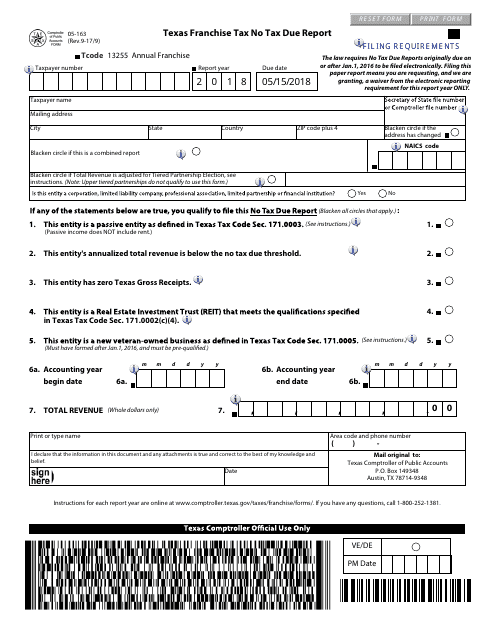

Form 05 163 Download Fillable Pdf Or Fill Online Texas Franchise Tax No Tax Due Report 2018 Texas Templateroller

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Texas State Taxes Forbes Advisor

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Inheritance And Estate Taxes Ibekwe Law

State Corporate Income Tax Rates And Brackets Tax Foundation

Comments

Post a Comment